Bahaya asap rokok tidak bisa dianggap remeh. Menurut penelitian terbaru, asap rokok dapat meningkatkan risiko kanker paru hingga 20 kali lipat. Hal ini tentu sangat mengkhawatirkan dan menjadi sebuah alarm bagi para perokok maupun orang-orang di sekitar mereka.

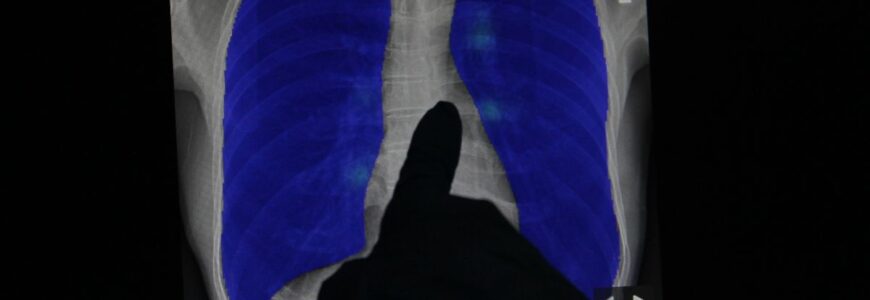

Kanker paru merupakan salah satu jenis kanker yang paling mematikan di dunia. Penyebab utama dari kanker paru adalah asap rokok, baik yang dihisap langsung oleh perokok maupun yang dihirup oleh orang-orang di sekitar perokok pasif. Asap rokok mengandung berbagai zat berbahaya seperti tar, nikotin, karbon monoksida, dan banyak zat kimia lainnya yang dapat merusak sel-sel paru-paru dan menyebabkan pertumbuhan sel-sel kanker.

Studi terbaru yang dilakukan oleh para ahli kesehatan menunjukkan bahwa risiko terkena kanker paru bagi perokok aktif 20 kali lebih tinggi dibandingkan dengan mereka yang tidak merokok. Bahkan, risiko tersebut juga dapat meningkat bagi perokok pasif yang sering terpapar oleh asap rokok.

Tidak hanya kanker paru, asap rokok juga telah terbukti dapat menyebabkan berbagai penyakit serius lainnya seperti penyakit jantung, stroke, dan penyakit pernapasan kronis. Oleh karena itu, sangat penting bagi kita semua untuk menyadari bahaya asap rokok dan berusaha untuk menghindari atau berhenti merokok.

Untuk para perokok, segera hentikan kebiasaan merokok dan mulailah gaya hidup yang lebih sehat. Untuk orang-orang di sekitar perokok, hindari terpapar oleh asap rokok dan ajaklah perokok untuk berhenti merokok. Kesehatan adalah aset berharga yang tidak bisa kita tawar-tawar. Mari jaga kesehatan kita dan lingkungan sekitar dengan menghindari bahaya asap rokok. Semoga artikel ini dapat memberikan pemahaman yang lebih dalam tentang bahaya asap rokok dan mendorong kita semua untuk hidup lebih sehat.